Electric Cars: How to Lose the Early Majority and Alienate People

Electric cars will ultimately win, but tempo matters.

Bloomberg recently reported that 31 countries in the world have passed "a pivotal EV tipping point: when 5% of new car sales are purely electric."

This is great news. The idea is that from 5% things move fast, and there is no turning back: "Not a single country thus far has taken more than three years to go from 5% to 15% EVs".

However, the analysts at Bloomberg have to work quite hard to turn this trend into a rule. The US and South Korea are about to emerge as the exceptions with weak sales growth. Markets like Italy, Greece, and Canada are likely to follow, and incentives ending in many other markets might mean that more countries are at risk. That said, predicting the future is hard and Bloomberg's observation is encouraging.

What I would like to do is highlight a possible explanation as to why we see these deviations from the trend, and a rationale as to why this might be a greater obstacle than analysts, investors, and the automotive industry thinks. But as with any crisis (what crisis?) there is also an opportunity here [insert cliché Chinese character analogy here].

Electric cars are ultimately going to win because they are better at meeting customers’ needs. They are way, way more efficient, making them cheaper to run and far less polluting. At the same time, they are also quieter, easier and more fun to drive. But because they more advanced, electric cars also represent the greatest technological innovation the automotive industry has seen in a century. In an industry with a deeply engrained culture of adding features incrementally and making gradual improvements, electric cars represent a radical departure from the status quo.

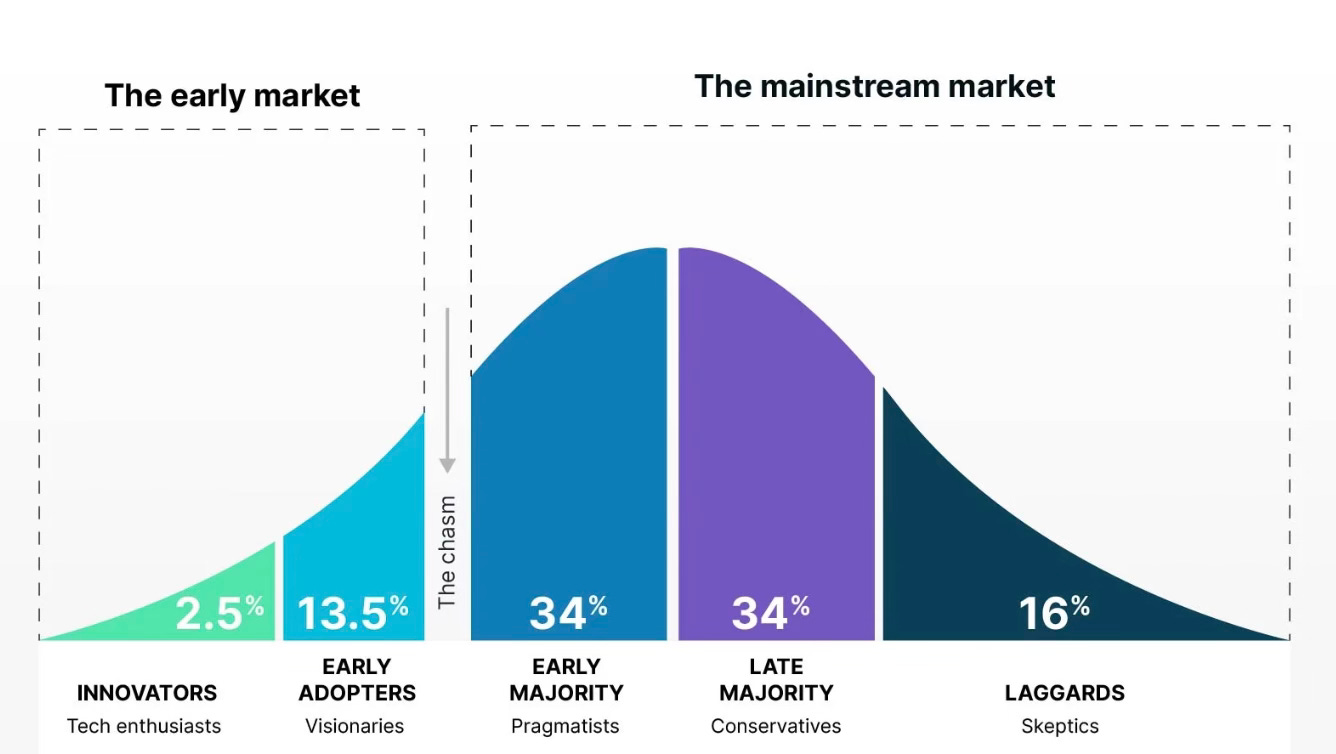

Enter the Innovation Adoption Curve, which will be familiar to many. This framework basically suggests that the diffusion of many technological innovations will have to progress through several customer segments that roughly follow a normal distribution.

The key point of adoption curves in marketing is this: customer segments have very different attitudes and needs, and your innovation will not succeed without meeting their needs. The Bloomberg analysis ends at 15% market share, right on the verge of the Early Majority segment - the first sizeable test for an innovation as part of the mainstream market.

Geoffrey A. Moore famously described this stage as the Chasm where many innovative technology companies fail. Now, the energy transition in automotive is complex and messy, with industrial policy and incentives motivated by geopolitics and economics trying to encourage large incumbents to electrify. But from the demand-side, as far as customers are concerned, switching to an electric car is not particularly different than the diffusion of other innovations.

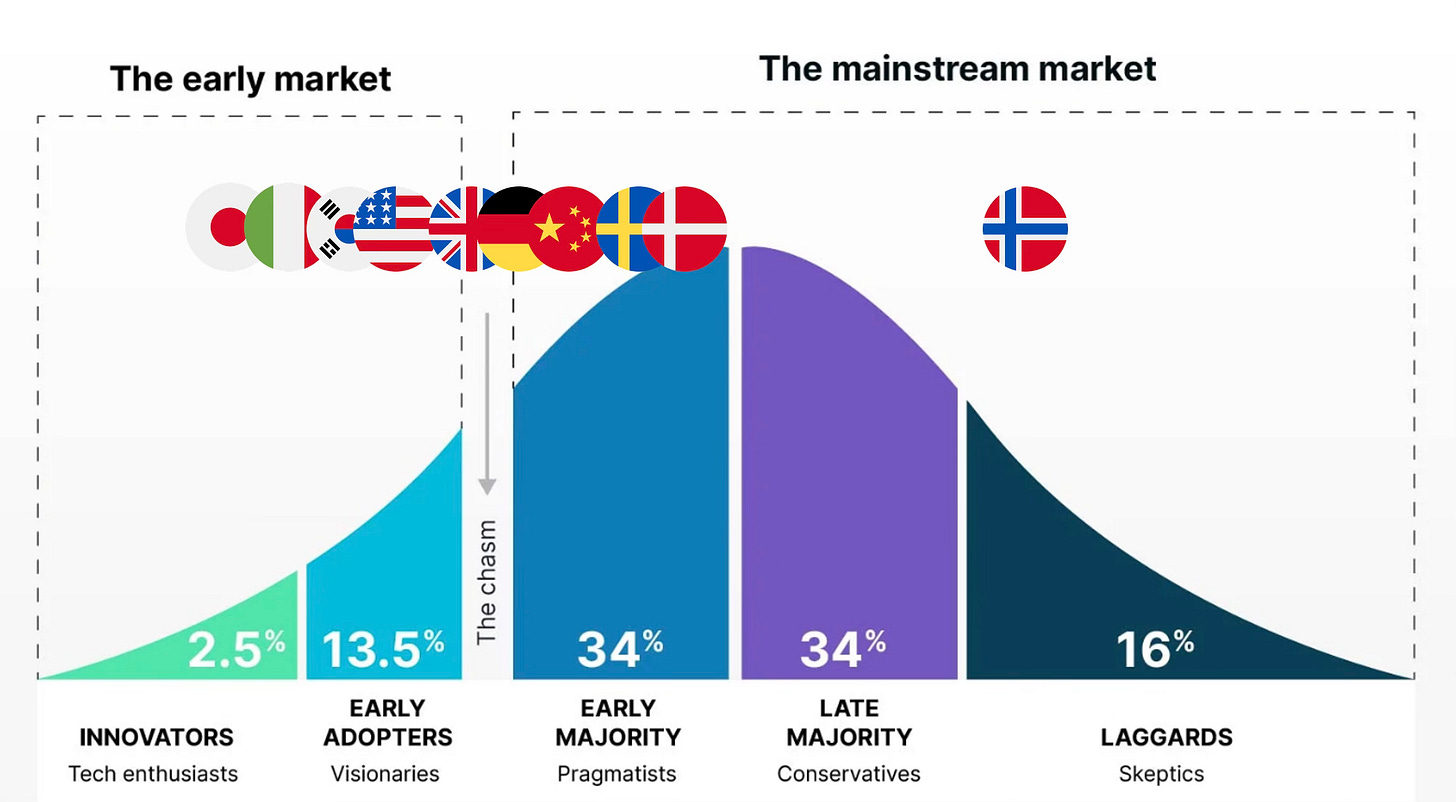

The view from the innovation adoption curve is that there are really only China and around 10 smaller nations led by Scandinavia, that have bridged the chasm so far. Most other major markets are still moving from Early Adopters towards the Early Majority.

The research I have led in this space shows that Early Majority customers - that is, people in the market for their first electric car today - have the typical pragmatic attitudes and needs that we expect from this segment. We will come back to the data on the Early Majority customer attitudes and needs in a future article, but here is a preview.

Early Majority Customers:

Want a car that just works, especially when they go on a family holiday or home to visit family for Christmas.

Are price conscious, and think EVs might be more expensive to run as well as being more expensive to buy.

Value convenience, they think that they have to drive around to look for chargers and then sit and wait for an hour or more.

Care about climate change, but are not convinced that EVs are better for the environment all things considered.

Worry about their bills, and think that all that electricity electric cars use might see their utility bills skyrocket, while filling their current car up is expensive but predictably so.

If you are reading this you are likely to be an Early Adopter, ready to take on each of these concerns with your knowledge of the facts. But go through the themes bulleted above and think of the last time you saw an ad or an article reassuring its audience on each one? What we need now is for the entire ecosystem to continuously reassure Early Majority customers in relation to their key needs and barrier to adoption, and that is not happening.

Volkswagen ad 2024

The good news is that shifting attention to meeting customer needs is a highly cost-effective approach, whether you are a policy-maker funding incentives or an automotive executive with a customer acquisition strategy. Compared to making batteries charge faster, meeting Early Majority customers where they are, listening to them, and reassuring them of what your car can already do is cheap.

Electric cars will ultimately win, but the energy transition and net-zero is a question of tempo. For individual companies in the market, most of which have now internalised that EVs are the future, navigating the transition in such a way as to come out on top of the competition will be a matter of survival. Attracting and winning the Early Majority customers therefore represents the grand prize for the next five years.

Sources:

Bloomberg "Electric Cars Pass the Tipping Point to Mass Adoption in 31 Countries"

Geoffrey A. Moore “Crossing the Chasm: Marketing and Selling High-Tech Products to Mainstream Customers”

Transport & Environment “The ‘early majority’: the next phase of the EV transition in the UK”