What Mainstream Electric Car Buyers Want

Perceived risk is holding back the tempo of mainstream EV adoption

As the market for electric cars is moving from Early Adopters to the mainstream, customers’ needs and expectations are changing dramatically. The stakes are high in winning the mainstream and the first meaningful volumes that it represents. Stellantis CEO Carlos Tavares described the coming years as “a challenging period, very chaotic, very Darwinian.” “We are in the storm,” he continued, “and it’s going to put a number of companies in trouble.”

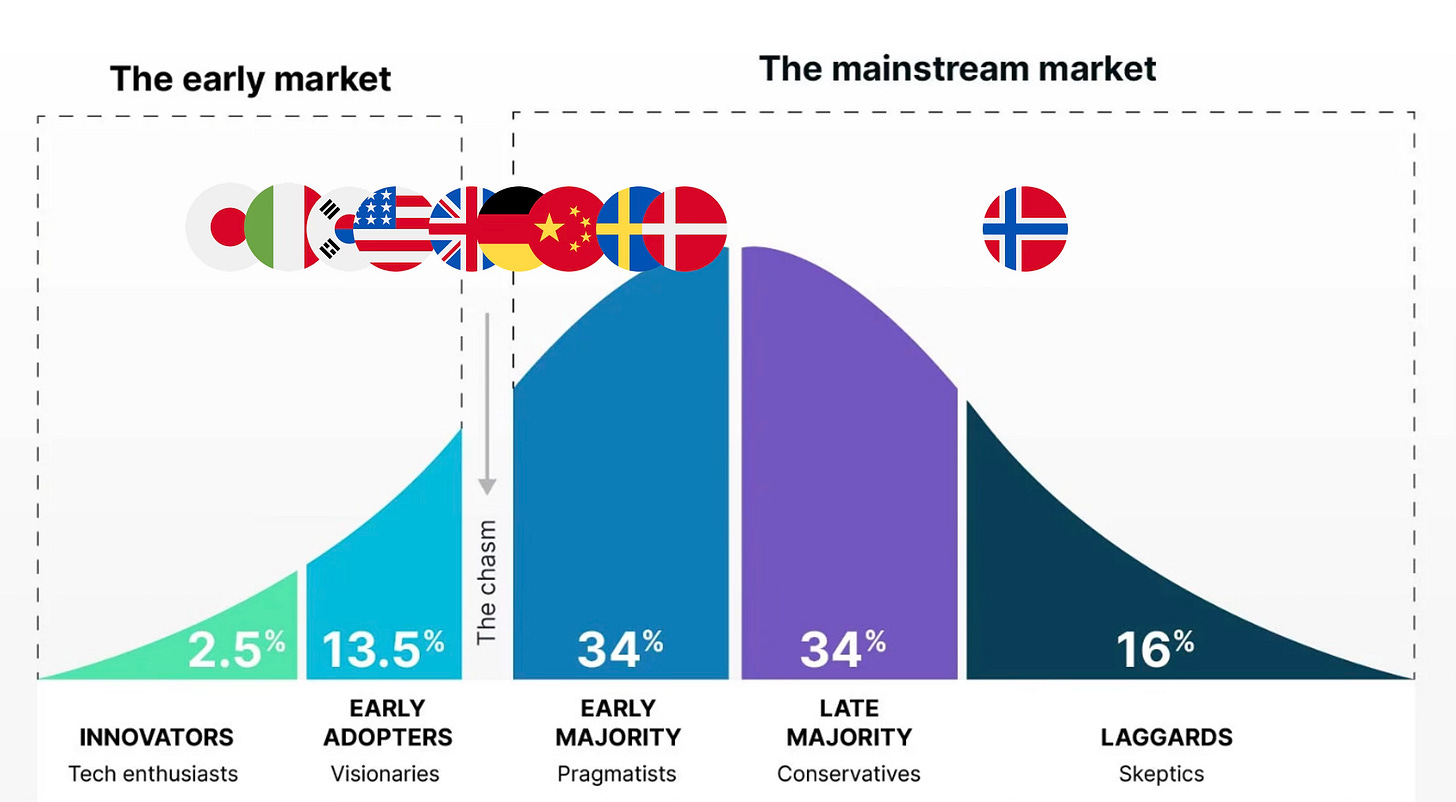

In a previous article, I wrote about where key global markets are on the technology adoption curve. The focus here will be on how these new, mainstream Early Majority customers are different, and what they need to continue to drive adoption.

The automotive industry and policy-makers have focused on increasing range, adding features, building out charging infrastructure, and reducing cost. These efforts have been necessary, but they have not been sufficient. Technological improvements and cost-reductions have accelerated the tempo of adoption, but we are not on track to keep pace with our net-zero targets. Something which car companies are painfully aware of since in many markets these net-zero targets are translated into legally enforced electric car sales targets.

Psychological Safety

In order to understand why the tempo is lagging, we need to understand what is really holding Early Majority customers back. The key concept of the demand-side of technology adoption is that of perceived risk, first introduced by Raymond A. Bauer and developed by Everett M. Rogers in the early 1960’s, and then later expanded by Jacob Jacoby and Louis B. Kaplan a decade later.

The important idea here is that Early Majority mainstream consumers are both more risk-averse and view the risks differently than Early Adopters. Warren Schirtzinger later described this as the Early Majority’s need for psychological safety. While Early Adopters are looking for breakthroughs, the Early Majority is much more focused on avoiding failure and ensuring stability.

Geoffrey A. Moore later emphasised that Early Majority customers were looking for a whole product solution, i.e. product that just works, meets all key customer needs, and has infrastructure such as service and support around it.

Perceived Performance Risk

I have been fortunate to lead a few research projects into Early Majority EV customers, most recently in the U.K. commissioned by Transport & Environment, where we gained a clear understanding of what is holding back adoption. We will use some examples from the U.K. below, but the core principles hold in many comparable markets.

WARNING to my friends who are automotive engineers: human beings are messy and what follows is not always rational and motivated by objective facts.

People who are in the market for a new car in the UK today and are open to the idea of an electric car, are far from experiencing psychological safety. Electric cars are still something relatively unknown and unproven, despite seeing them on the roads and knowing someone who drives one.

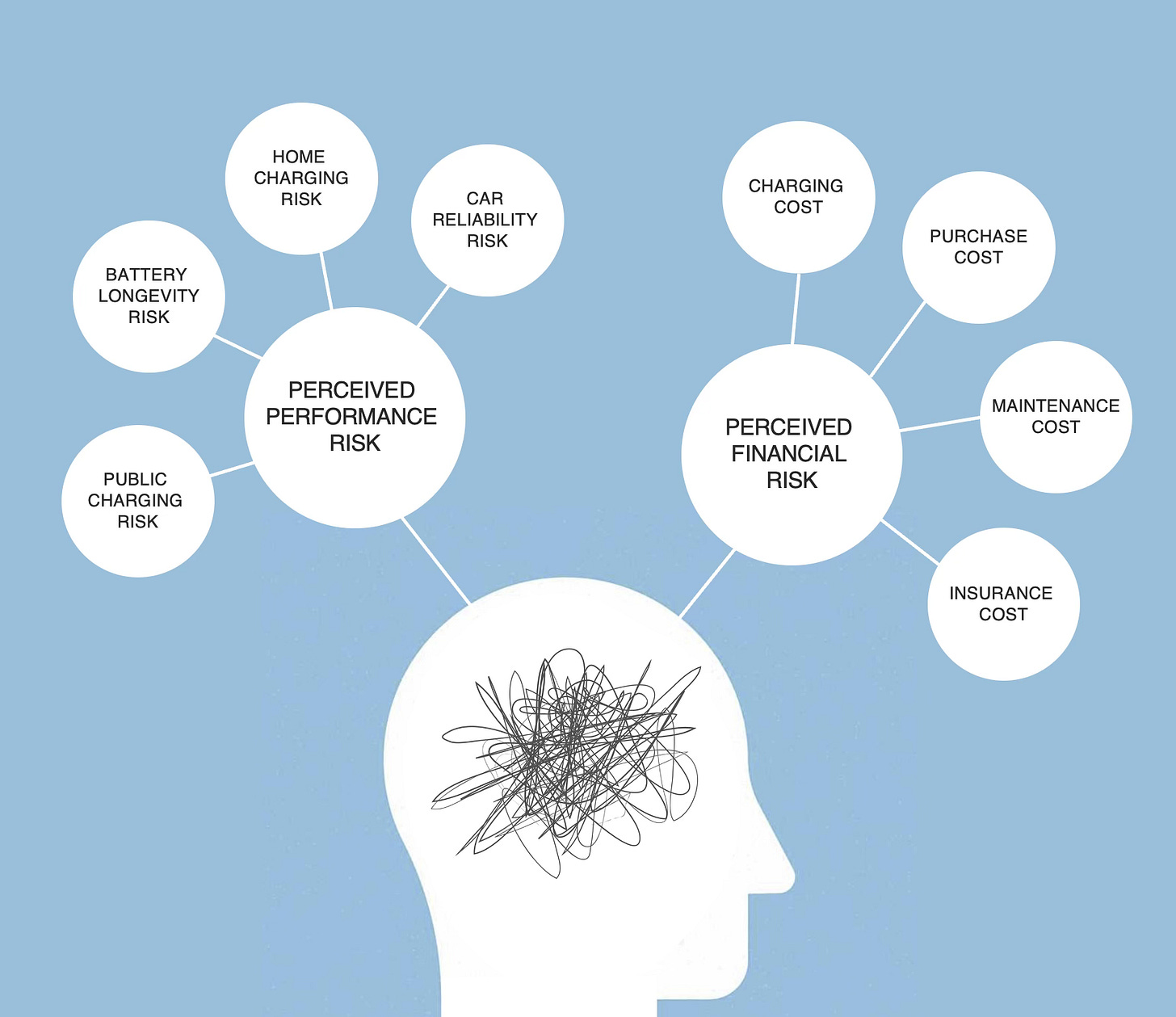

Their key perceived risks are twofold: perceived performance risk and perceived financial risk.

Perceived performance risk is not, as is commonly believed, directly related to individual features such as range. What we learnt in our research is that it rather stems from the Early Majority customers’ general lack of trust and familiarity with electric cars.

Adopting an electric car requires these customers to:

Change how they think about a car

Change how they drive

Change where and how often they fuel their car

Change where and how they maintain their car, and for many to

Install a home charger

Switch their electricity provider and tariff

Switch their insurance company

While Early Adopters see this as an exciting opportunity to learn and impress others, for Early Majority customers this is a daunting, anxiety-ridden task. We see Early Majority customers describing electric cars as premium and aspirational, but fundamentally alien and therefore suspect. The perceived performance risks are often quite emotional and abstract, but they are expressed as rational and fact-based.

“I worry about not wanting to put the heating on in the car, no electricity left, it sounds quite miserable, I don’t want to worry about putting the radio on. I spend a lot of time in my car I want to enjoy the journeys that I do”

- Early majority customer, U.K.

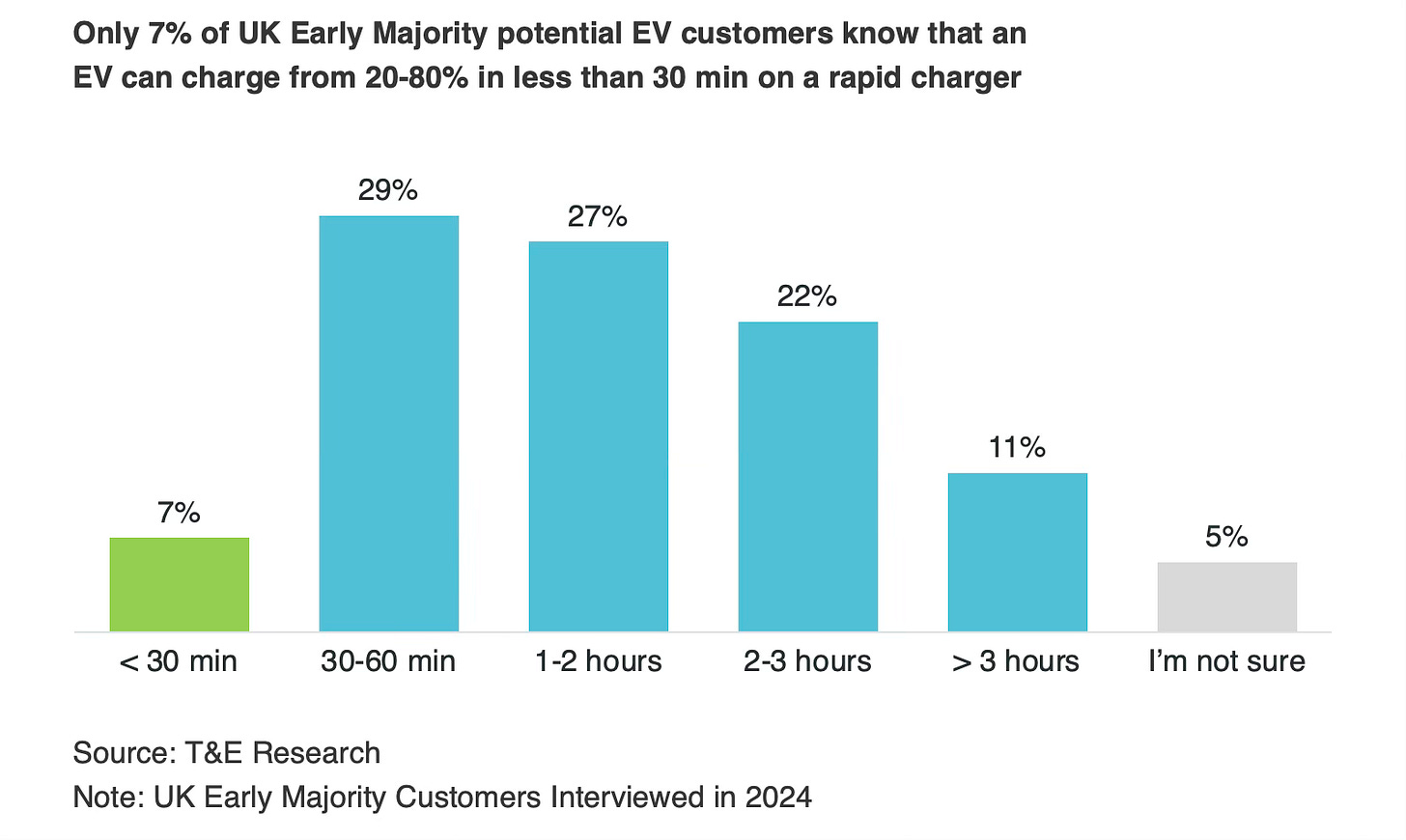

When asked about their key concerns about electric cars, the most important performance issues center around charging availability and speed, battery longevity and maintenance.

Reassuring directly on these topics can certainly be helpful, but with the awareness that what matters is the overall feeling of psychological safety.

“My friends that have full electric have all had horror stories and that’s why I want to stay clear of them until they’re more reliable - chargers not being in working order, not being in range, not putting on the heating or radio on because of battery drain.”

- Early majority customer, U.K.

Perceived Financial Risk

The second important barrier is perceived financial risk. Again, even though many of these concerns are rational, such as electric cars are more expensive to buy than fossil fuel cars, the important lens is the emotional one of psychological safety. When Early Majority customers talk about their key concerns, the most important financial concerns relate to purchase price, but also increasing electricity bills and worries about the total cost of ownership.

"I know the electricity would be higher due to rising cost of living. Electricity bill is still high without charging car at home yet. I'm just imagining how much it would cost me.”

- Early majority customer, U.K.

“I have heard that electric cars are way more susceptible to break-downs.”

- Early majority customer, U.K.

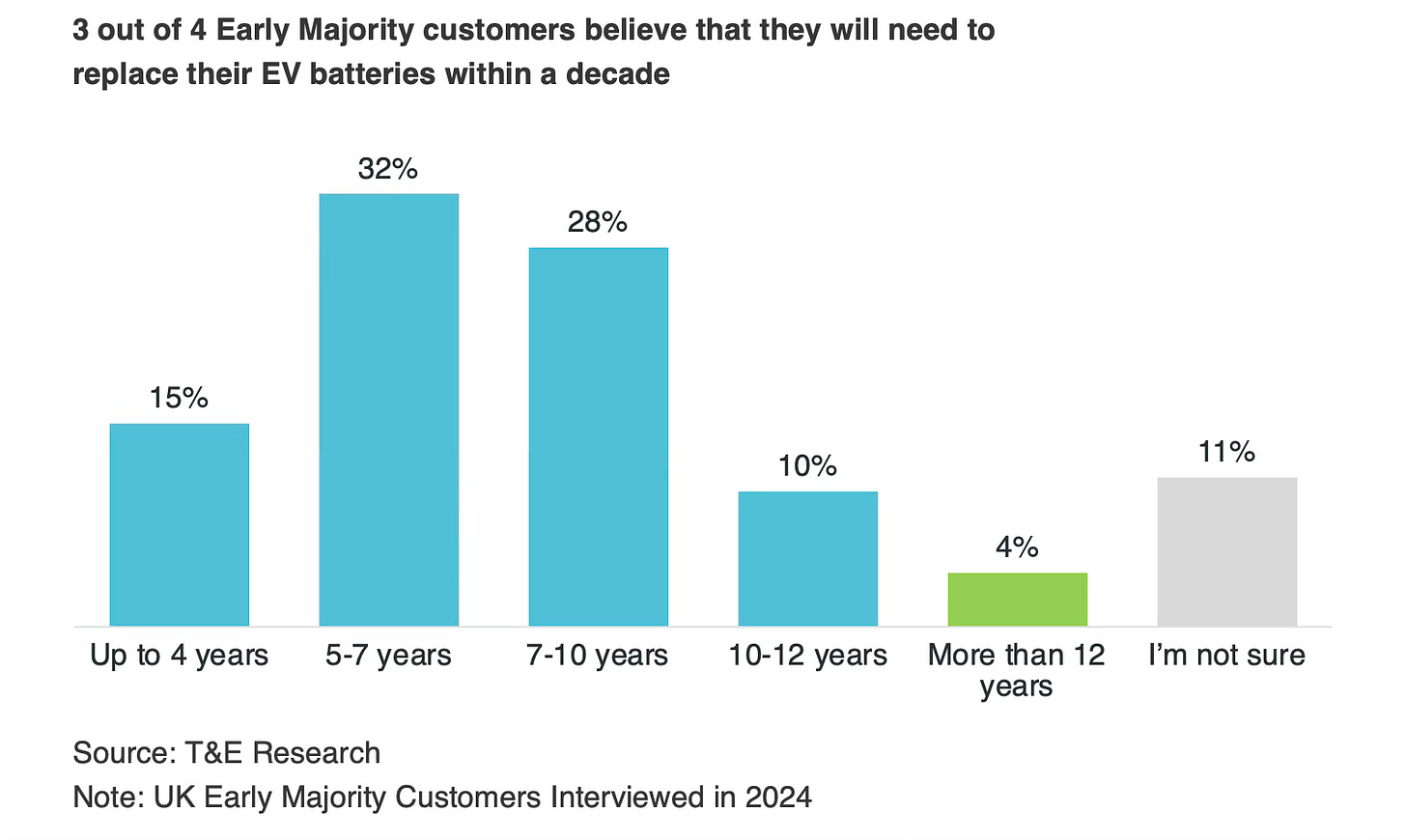

They are not sure what miles per kWh means, what it costs to charge their car, if they can trust a smartphone on wheels and how reliable it is compared to a fossil car. What if that large, expensive battery degrades after a couple of years like my phone? That sounds really expensive. All of these knowledge gaps add up to a considerable barrier of perceived financial risk.

“I tend to keep the car for 5-7 years. I’m worried about electric issues with it or the battery – the dealer will say replace the battery. It’s going to cost fifteen grand to repair.”

- Early majority customer, U.K.

I know what you are thinking: batteries last for 15+ years without significant degradation and often come with 8 year or 100,000 mile warranties. Electric cars are dramatically cheaper to charge and maintain than their ICE equivalents. Many beliefs to the contrary are created or reinforced by disinformation supported by vested interests. And you are right.

But explaining this to the Early Majority customers is at best a partial solution. Remember, what these customers need to lower the barriers to adoption is an overall feeling of psychological safety. The facts can be helpful, but they are ultimately unnecessary once the feeling is internalised that electric cars can be trusted because they perform better and are cheaper over time than fossil cars.

Establishing Psychological Safety

So what to do? Now that we know what Early Majority customers want, how can we deliver? Two things are hopefully clear so far. First, we are trying to create an environment of psychological safety. Secondly, that facts and incentives are only helpful if they are delivered by trustworthy sources to help reassure and build a sense of safety in the adoption decision.

From the research I have led in this area the overall most effective approaches to accelerating Early Majority adoption can be divided into three areas:

Reassurance guarantees

Social proof and education

Whole product support

I will expand upon these in a future artcile with some practical advice for each, but the good news is this - what they have in common is that they can be deployed rapidly, do not require huge up-front investment and have the potential to yield a high return on investment.

Exceptionalism Is Slowing Us Down

From all of the research I have seen, it is obvious that perceived risk is the key barrier for Early Majority electric car buyers. However, when I talk to professionals in the EV eco-system, this perspective rarely comes up. Stakeholders on the inside recognise that there are knowledge gaps, and vent their frustration with misinformation, but often adoption is viewed as a foregone conclusion. The Early Adopter sales figures look like the beginning of an s-curve and, you know - if we build it, they will come.

There seems to be an unwillingness to treat the diffusion of EVs as an innovation like any other. This one is special. Perhaps because policy-makers, analysts, NGOs and the automotive industry have already agreed that the transition is necessary and, by now, inevitable. They are right, but we return to point on tempo: EV adoption is not on track for net-zero and the Early Majority will be crucial in setting the tempo for the next decade.

As the Rocky Mountain Institute states in an important recent publication: “The direction is inevitable, but the speed is up to us”. Bill McKibben when commenting on this data said: “The difference between ‘fast’ and ‘faster’ is what I’ve been describing—the shaded areas between them may well be the most important shade on an ever-warmer earth.” I couldn't agree more.

Sources:

Raymond A. Bauer (1960) Consumer Behavior as Risk-Taking in Dynamic Marketing for Changing World

Jacob Jacoby and Louis B. Kaplan (1972) The Components of Perceived Risk in Proceedings of the Annual Conference of the Association for Consumer Research

Warren Schirtzinger (2024) Accelerating the Adoption of Electric Vehicles: A presentation to the Association of Energy Services Professionals (AESP)

Geoffrey A. Moore (1991) Crossing the Chasm: Marketing and Selling High-Tech Products to Mainstream Customers

Autotrader (2024) Road to 2035

Bloomberg (2024) EV Slowdown Steers the World Further Off Course From Net Zero

Transport & Environment (2024) The ‘early majority’: the next phase of the EV transition in the UK